#10- An executor or administrator gives a power of attorney to a third party. Fiduciaries cannot delegate their authority.

#9- The Seller does not come to closing with certified funds for transfer taxes. Most Title companies will not take a personal check for transfer taxes unless authorized prior to closing.

#8- The Buyer unaware that the bank deducts closing costs from mortgage proceeds and fails to bring certified funds to make up the difference.

#7- The Executor of a Will that was not probated arrives at closing without Letters Testamentary.

#6- A Religious Corporation arrives at closing without a Supreme Court order authorizing the sale.

#5- The Seller arrives at closing with a payoff letter showing legal fees due. Seller may be in default on mortgage and must be in compliance with Home Equity Theft Protection Act.

#4- A child of the deceased owner who lives in the house arrives at closing to execute the deed without an Administrator or an Affidavit of Heirship.

#3- A seller with a docketed judgment that was discharged in bankruptcy believes he can sell the property free of that judgment.

#2- Only one Executor shows up to the closing when Letters Testamentary where issued to two executors.

The Number 1 Reason is: Will names a specific person to receive the property but the Executor attends the closing to execute the deed.

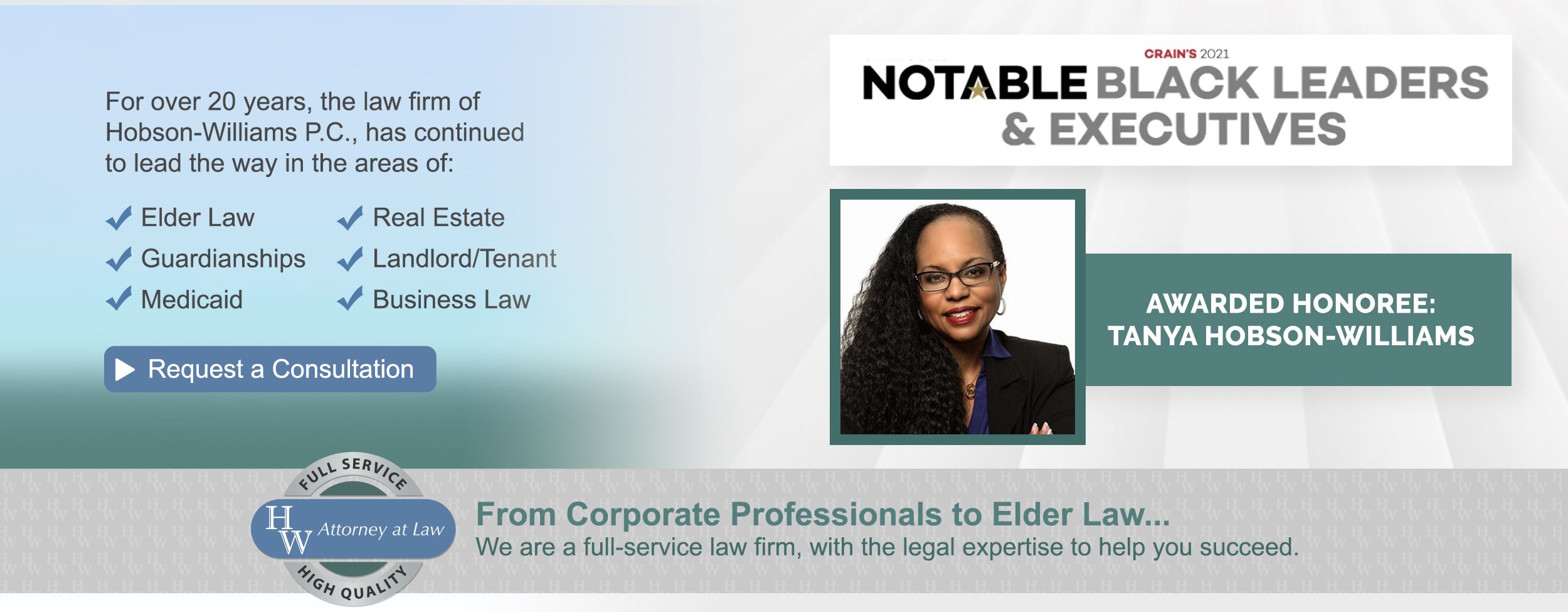

*Make sure your Estate Attorney and Real Estate Attorney are knowledgeable about the relationship between estate matters and the purchase and sale of property. Contact Attorney Tanya Hobson-Williams at (718) 210-4744 for more information.