The “Setting Every Community Up for Retirement Enhancement” Act (SECURE Act) was signed into law this past December, and it has potential ramifications for anyone who has a retirement account. In particular, it will have significant ramifications for anyone engaged in estate planning whose retirement accounts may disburse payments after they have passed away. As such, anyone trying to plan their estate with a retirement account should be aware of the impact the law might have on you and your loved ones. Continue reading “SECURE Act Could Have Major Impact on Your Retirement Account”

Category: Elder Law

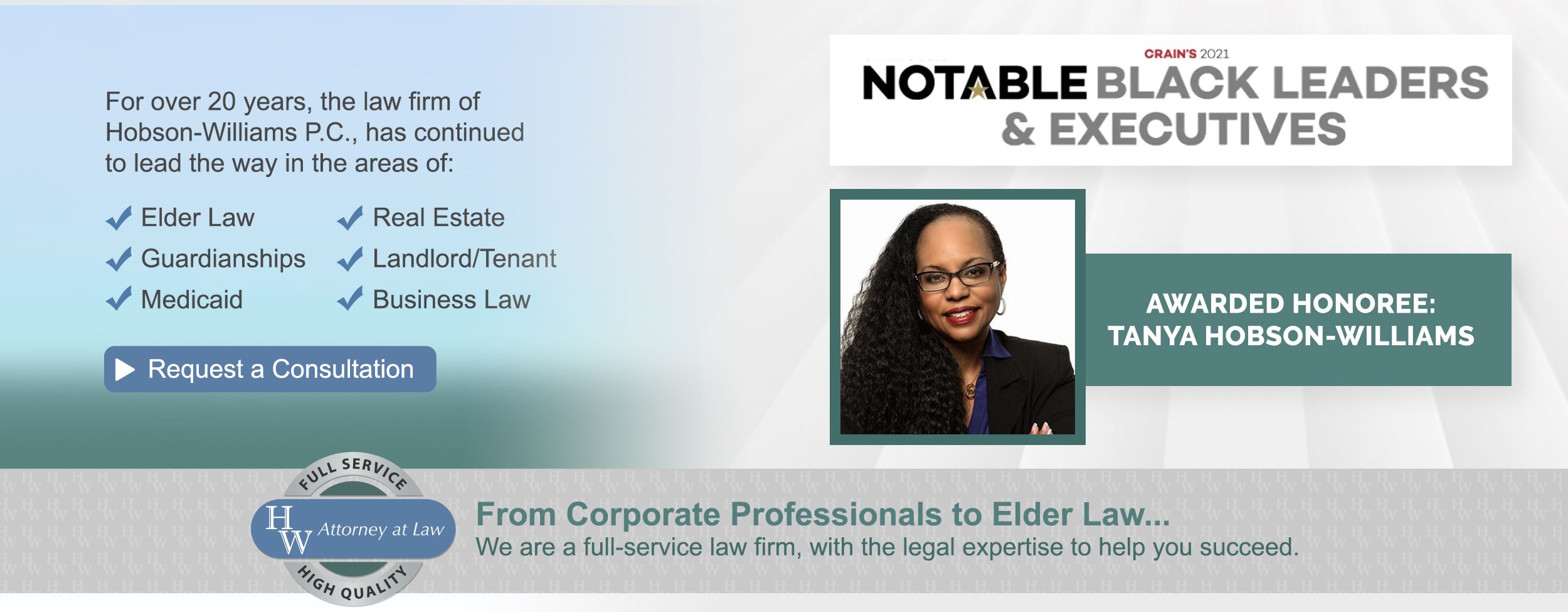

Tanya Hobson Williams’ New York Elder Law Blog

The Perils of a Reverse Mortgage

You may have seen television commercials advertising reverse mortgages, telling you about the financial rewards that can come from taking a reverse mortgage on your home. While it can theoretically result in additional money in your pocket, at least in the short term, it’s important not to mistake it for a financial windfall. You should be aware of the perils of a reverse mortgage before you take one out on your home. Continue reading “The Perils of a Reverse Mortgage”

Five Things to Consider When Planning Your Estate

Estate planning is an important task for anyone advancing in years, especially for anyone with a large amount of property that will need to be allocated after your demise. But what do you need to consider when you’re planning your estate? What can you do to avoid catastrophe when the worst comes to pass? Well, here’s five questions to ask yourself when you’re planning your estate. Continue reading “Five Things to Consider When Planning Your Estate”

When to Consider a Power of Attorney

If you have family members that are growing older or have a loved one with diminished ability to care for themselves, you may need to consider a power of attorney. But what is a power of attorney? And when is it appropriate to consider for yourself or your loved ones? Continue reading “When to Consider a Power of Attorney”

Considering Advance Directives

If you or a loved one are advancing in age, or if your health is deteriorating, it may be wise to investigate the possibility of advance directives. Broadly speaking, advance directives are legal documents that convey your desires, if you are incapable of making those desires known yourself. The term “advance directives” generally covers four kinds of documents: living wills, health care proxies, powers of attorney, and Do Not Resuscitate orders (DNRs). Continue reading “Considering Advance Directives”

What is a Guardianship?

Chances are that, at some point in your life, you’ve heard of a “guardian” before, especially in the context of children, or older relatives, or people with certain disabilities. However, you might not know what a guardian is, or why someone might have one. Fortunately, the idea is easy to understand, and it’s good to know about just in case you, or someone you know, has a guardian appointed for them. Continue reading “What is a Guardianship?”

As Population Ages, Demand for Elder Law Attorneys Grows

The U.S. Census Bureau is predicting that, by 2035, there will be more people over the age of 65 than children under the age of 18 in the United States. This would be the first time in United States history that the elderly has outnumbered children resulting from multiple ongoing trends, such as longer life spans among the elderly and declining birth rates among millennials. This means that the need for elder law attorneys, and other people who specifically deal with issues related to the elderly, will become more important than ever.

Continue reading “As Population Ages, Demand for Elder Law Attorneys Grows”

What is a Reverse Mortgage?

As Americans grow older and with a majority of the older population now entering retirement, the need for income sufficient to cover expenses becomes greater. While there are programs such as Medicare, Medicaid, Social Security, and Supplemental Security Income, that help seniors with income and healthcare, those programs may not be enough for some individuals to pay for their monthly expenses or healthcare costs. There is another option that is available to many Americans over the age of 62, such as a reverse mortgage.

Continue reading “What is a Reverse Mortgage?”

Protecting Against Caregiver Theft

Over the past decade, the home health care industry has expanded dramatically with more than 200,000 New Yorkers reporting paid caregivers as their primary occupation. According to a study conducted by the Bureau of Labor Statistics, home health careers are expected to see the most rapid growth than other technical fields by 2026 and that by 2040, New York City will have an estimated 1.4 million seniors; approximately 70-percent of which will be in-need of long-term care services.

Continue reading “Protecting Against Caregiver Theft”

Guildnet Closes Its Doors

On August 21, 2018, Guildnet CEO, Alan R. Morse, notified employees that the company will be closing its doors as of December 1, 2018, leaving New Yorkers in need of managed long-term care (MLTC) services at a disadvantage. The Guildnet program was designed to offer therapeutic/medical care, home healthcare services, case management, and medical equipment to those who qualify and will be in need of the provided services for a minimum of 120 days. Guildnet announced that by January 1st of 2019, all medical services to their 8,211 managed long-term care members will be terminated. United Healthcare, who until recently offered a partial MLTC plan, will also be pulling out of several counties in up-state New York by February of 2019, affecting nearly 1,500 enrollees who are said to be notified of these changes by November.

Continue reading “Guildnet Closes Its Doors”