If you’ve ever been involved in buying or selling real estate, you might’ve heard about “covenants” and “easements,” and maybe even had to go through some bureaucratic pains to deal with them. They’re certainly an important part of any discussion about the sale of property, since they can seriously impact how you use and enjoy that property. But what is a covenant or an easement, and how could it impact the sale of your property? Continue reading “Covenants and Easements”

Tag: Real Estate Lawyer

Landlord Who Bilked Banks out of Millions of Dollars Sued for Harassment

An East Village landlord who was recently arrested for allegedly taking out millions of dollars in loans through fraudulent means is also facing a civil lawsuit filed by New York State Attorney General Eric Schneiderman. According to an article by Crains New York Business, it is alleged that the landlord illegally harassed tenants in the rent-regulated apartments he owned by attempting to have them evicted so he could charge higher rents.

Continue reading “Landlord Who Bilked Banks out of Millions of Dollars Sued for Harassment”

Top Ten Estate Reasons Real Estate Closings Get Adjourned

#10- An executor or administrator gives a power of attorney to a third party. Fiduciaries cannot delegate their authority.

#9- The Seller does not come to closing with certified funds for transfer taxes. Most Title companies will not take a personal check for transfer taxes unless authorized prior to closing.

#8- The Buyer unaware that the bank deducts closing costs from mortgage proceeds and fails to bring certified funds to make up the difference.

#7- The Executor of a Will that was not probated arrives at closing without Letters Testamentary.

#6- A Religious Corporation arrives at closing without a Supreme Court order authorizing the sale.

#5- The Seller arrives at closing with a payoff letter showing legal fees due. Seller may be in default on mortgage and must be in compliance with Home Equity Theft Protection Act.

#4- A child of the deceased owner who lives in the house arrives at closing to execute the deed without an Administrator or an Affidavit of Heirship.

#3- A seller with a docketed judgment that was discharged in bankruptcy believes he can sell the property free of that judgment.

#2- Only one Executor shows up to the closing when Letters Testamentary where issued to two executors.

The Number 1 Reason is: Will names a specific person to receive the property but the Executor attends the closing to execute the deed.

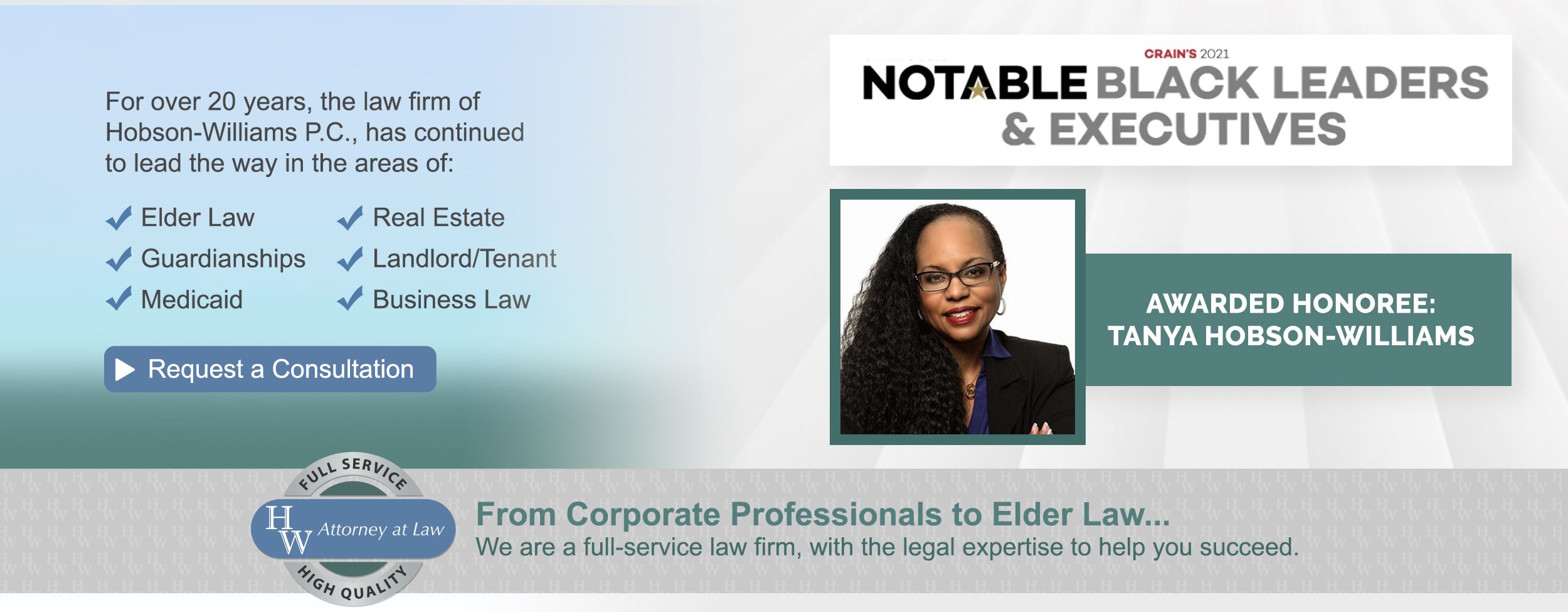

*Make sure your Estate Attorney and Real Estate Attorney are knowledgeable about the relationship between estate matters and the purchase and sale of property. Contact Attorney Tanya Hobson-Williams at (718) 210-4744 for more information.