A recent article on WealthManagement.com has reported that seniors feel the effects of inflation more than the rest of the population. Research shows that a major reason for this is due to the rising costs of healthcare. Although over the last three years, the costs of Medicare have tapered off due to the Affordable Care Act, J.P. Morgan Wealth Asset Management expects that Medicare costs will shift toward increasing 6.1% annually over the next twenty years. This means that a 65 year old paying $4,400 a year now will be spending $17,000 annually at age 85.

A recent article on WealthManagement.com has reported that seniors feel the effects of inflation more than the rest of the population. Research shows that a major reason for this is due to the rising costs of healthcare. Although over the last three years, the costs of Medicare have tapered off due to the Affordable Care Act, J.P. Morgan Wealth Asset Management expects that Medicare costs will shift toward increasing 6.1% annually over the next twenty years. This means that a 65 year old paying $4,400 a year now will be spending $17,000 annually at age 85.

Healthview Services conducted research that considered how inflation will affect the relationship between Medicare and Social Security benefits. If found that currently, health care costs consume 67% of social security benefits, and that number is expected to increase to 83% over the next twenty years. Additionally, some of the other factors traditionally used to offset health care costs are no longer as ubiquitous as they once were. For example, in 1988, 66% of employees at large companies received retiree health benefits. In 2013, only 28% of employees at large companies received them. Additionally, 38% of employees in the private sector received pensions, while only 15% did in 2010.

J.P. Morgan found that while other expenses went down after age 45 such as food, entertainment and apparel, medical expenses and charitable contributions increased.

Click here to read the full article.

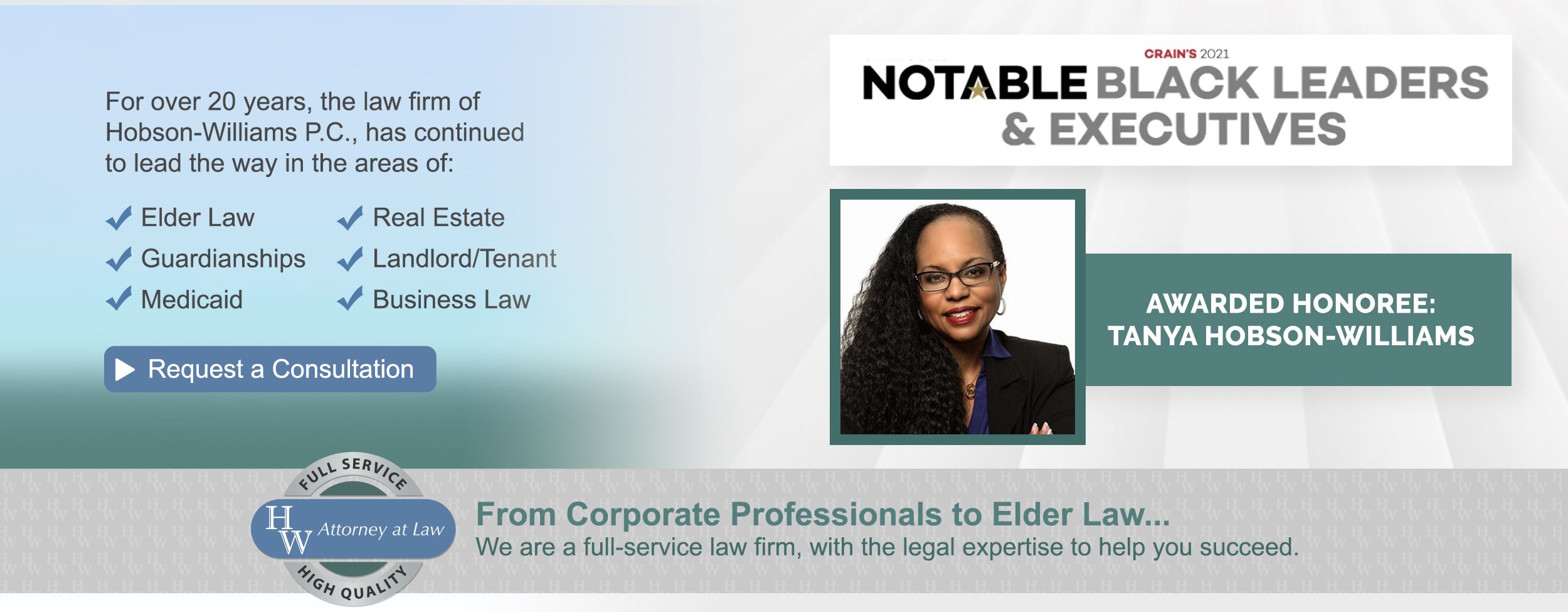

It is important to plan ahead for retirement as many unexpected expenses may arise, particularly regarding healthcare costs. If you are in the process of planning for retirement, it is best to consult with an attorney who can guide you in making the necessary arrangements and help you protect your assets. The attorneys at Tanya Hobson-Williams are available to set up a consultation at 866-825-1529.