On September 24, 2014, the Supreme Court of the State of New York Appellate Division: Second Department reversed a lower court’s order annulling the marriage between a younger woman and an elderly man. The Appellate Division determined that a new hearing on the man’s ability to enter into a marriage contract was warranted. Capacity, in a legal sense, refers to the ability to make a rational decision based upon all relevant facts and considerations.

The case involved an elderly man who was appointed a guardian by the New York Supreme Court to provide for his personal needs and property management. During the course of his guardianship, the elderly gentleman entered into a marriage with a younger woman. After being informed of the marriage, the guardian asked the Court to have a psychologist determine whether the elderly man had the capacity to enter into a marriage. After a hearing and testimony, the New York State Supreme Court determined that the elderly gentleman lacked the capacity to enter into a marriage, and, as a result, annulled the marriage.

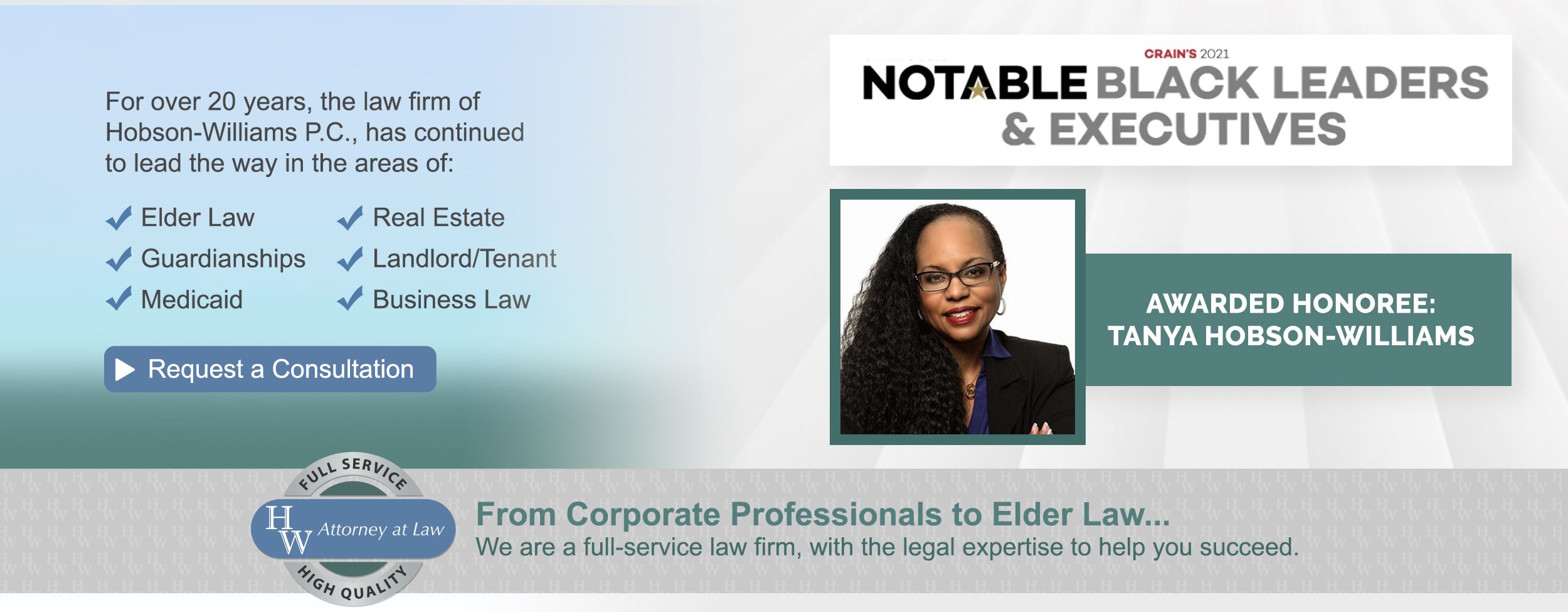

On Appeal, attorney Tanya Hobson-Williams, representing the young woman, argued that her client was not given any notice that her marriage would be annulled and that she lacked the opportunity to be heard by the court before it ultimately decided to annul the marriage to her late husband. While the petition to appoint a Guardian for the elderly man requested a determination of the elderly gentleman’s capacity to handle his affairs, neither the Petitioner nor the Guardian ever requested that the marriage be annulled. Essentially, all that was formally requested of the court was to determine matters pertaining to the level of guardianship. Continue reading “Tanya Hobson-Williams, P.C. Defends Client’s Marriage to Husband who was declared an Incapacitated Person Resulting in Wife Inheriting $3 Million Dollar Estate”